How to Trade Cryptocurrencies?

One commonality that all traders have is the need to find an edge in the market. An edge is a method or set of methods that can give you a higher probability of success than a random chance. In other words, an edge is your key to consistently making profitable trades. There are many different ways to find an edge in the market. Some traders use technical analysis, while others use fundamental analysis.

Some traders focus on a specific market, while others trade multiple markets. And some traders rely on pure luck! But the one thing that all successful traders have in common is that they all have a clear and defined trading edge. This article will discuss how you can develop an effective trading strategy.

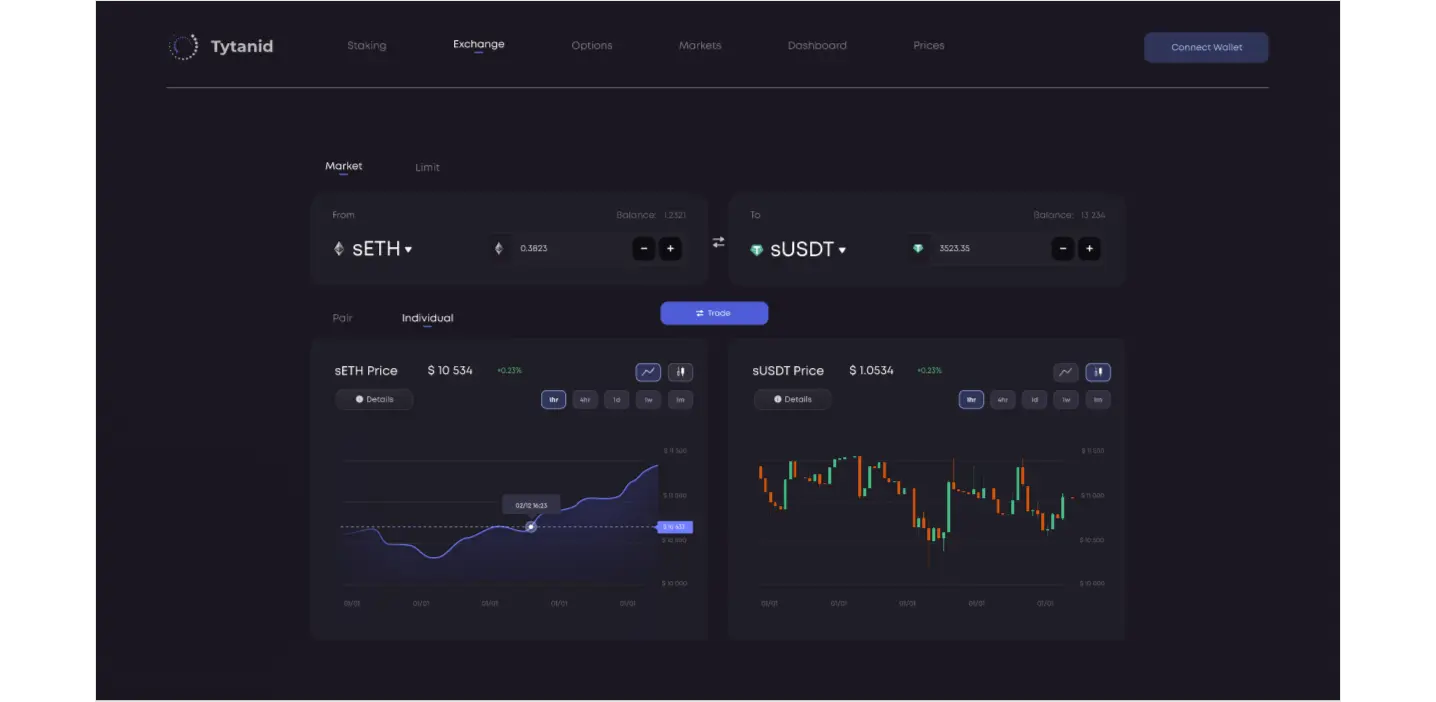

- Technical Analysis

Technical analysis is the most popular method of analyzing the crypto markets. Technical analysis is the study of past market data to identify patterns and trends.

Traders who use technical analysis believe that the market is a reflection of human psychology. And by understanding how people trade, they can get an edge in the market. There are many different ways to do technical analysis. Some traders focus on chart patterns, while others use indicators like moving averages. There is no one “right” way to do technical analysis. Rather, it’s a tool you can use to develop your trading edge.

- Fundamental Analysis

Fundamental analysis is another popular method of analyzing the crypto markets. Fundamental analysis is the study of a coin’s underlying technology and fundamentals. Traders who use fundamental analysis believe that a coin’s price reflects its underlying value. By understanding the technology and fundamentals of a coin, traders can get an idea of its true value. This, in turn, can give them an edge in the market. Fundamental analysis is a bit more difficult than technical analysis. And it’s often more time-consuming. But if you’re willing to put in the work, it can be a powerful tool in your trading arsenal.

- Sentiment Analysis

Sentiment analysis is a relatively new method of analyzing markets. Sentiment analysis is the study of how people feel about a certain coin. This can be done by monitoring social media, forums, and other online sources. Sentiment can be a very powerful indicator.

The world of cryptocurrency is vast and complicated, but there are ways to make sense of it. By reading crypto blogs, you can learn about the different aspects of the industry and how to make informed investment decisions.

As a writer, Ruben is an advocate of blockchain technology and cryptocurrency in general. He writes about all things from cryptography to economics, with a focus on how it applies to cryptocurrencies. He is also passionate about writing about topics such as decentralization, open-sourced software development, and copyright law.