How Does Leverage Trading Work in Cryptocurrency?

Introduction

Imagine this: you’ve heard about the exciting world of cryptocurrency trading and want to make the most of it. That’s where leverage trading comes in. But what exactly is it, and how does it work? Let me break it down for you. Leverage trading amplifies your trading power, enabling you to control larger positions with less capital. It’s like borrowing funds from a platform to increase your potential returns. However, it’s crucial to understand the mechanics, risks, and strategies to navigate this thrilling yet volatile space successfully.

Related suggestions: What is NGMI in Crypto

Content

The Mechanics of Leverage Trading

Once you grasp the concept of leverage trading, it’s time to delve into its mechanics. Understanding leverage is vital to making informed trading decisions and managing risk effectively. Let’s explore the intricacies of leverage trading in the crypto market and discover how it operates.

How Leverage Ratios Work

Leverage ratios determine the amount of capital you can borrow from a platform or exchange to open larger trading positions. For instance, a leverage ratio 10:1 means you can control a ten times larger position than your invested capital. This amplifies both potential profits and losses.

Calculating Leverage and Margin Requirements

To calculate leverage, divide the total position value by your invested capital. Margin requirements, expressed as a percentage, represent the portion of the total position value you must provide as collateral. For example, if the margin requirement is 10%, you must put down 10% of the position’s value, and the platform covers the remaining 90%.

Long and Short Positions

In leverage trading, you can take both long and short positions. A long position involves buying an asset with the expectation that its value will rise, allowing you to sell it later at a higher price. A short position involves borrowing and selling an asset with the anticipation that its value will decrease. You can then buy it back at a lower price.

Managing Risk with Stop-Loss Orders

Implementing stop-loss orders is crucial in leverage trading to mitigate potential losses. A stop-loss order is a predetermined price level at which you automatically exit a trade to prevent further losses. By setting a stop-loss order, you establish a safety net that limits your exposure to market volatility.

By grasping these essential mechanics, you’ll have a solid foundation for navigating the world of leverage trading in cryptocurrencies. Understanding leverage ratios, margin requirements, and long and short position dynamics are paramount to managing risk and maximizing your potential profits.

4 Strategies for Successful Leverage Trading

Now that we understand the mechanics of leverage trading, we must uncover strategies to help us navigate this dynamic market successfully. By employing these proven strategies, we can enhance our chances of making informed decisions and optimizing our trading outcomes. Let’s explore some effective strategies for successful leverage trading in the crypto market.

1. Conducting Thorough Research and Analysis

Before entering any trade, conducting thorough research and analysis is crucial. This involves studying market trends, analyzing historical price data, and staying updated with the latest news and developments in the crypto space. We can make informed decisions and identify potential trading opportunities by arming ourselves with relevant information.

2. Setting Realistic Profit Targets and Stop-Loss Levels

Setting realistic profit targets and stop-loss levels is important to achieve consistent success in leverage trading. By defining our profit targets, we can identify the point at which we will exit a trade to secure our gains. Similarly, setting stop-loss levels helps protect us from significant losses by exiting a trade if it moves against us beyond a certain threshold.

3. Applying Risk Management Techniques

Effective risk management is paramount in leverage trading. One popular technique is position sizing, allocating a specific percentage of our total capital to each trade. This approach ensures we don’t overexpose ourselves to a single trade and helps manage our overall risk exposure. By diversifying our trades and using appropriate position sizing, we can protect our capital and minimize potential losses.

4. Utilising Technical Indicators and Chart Patterns

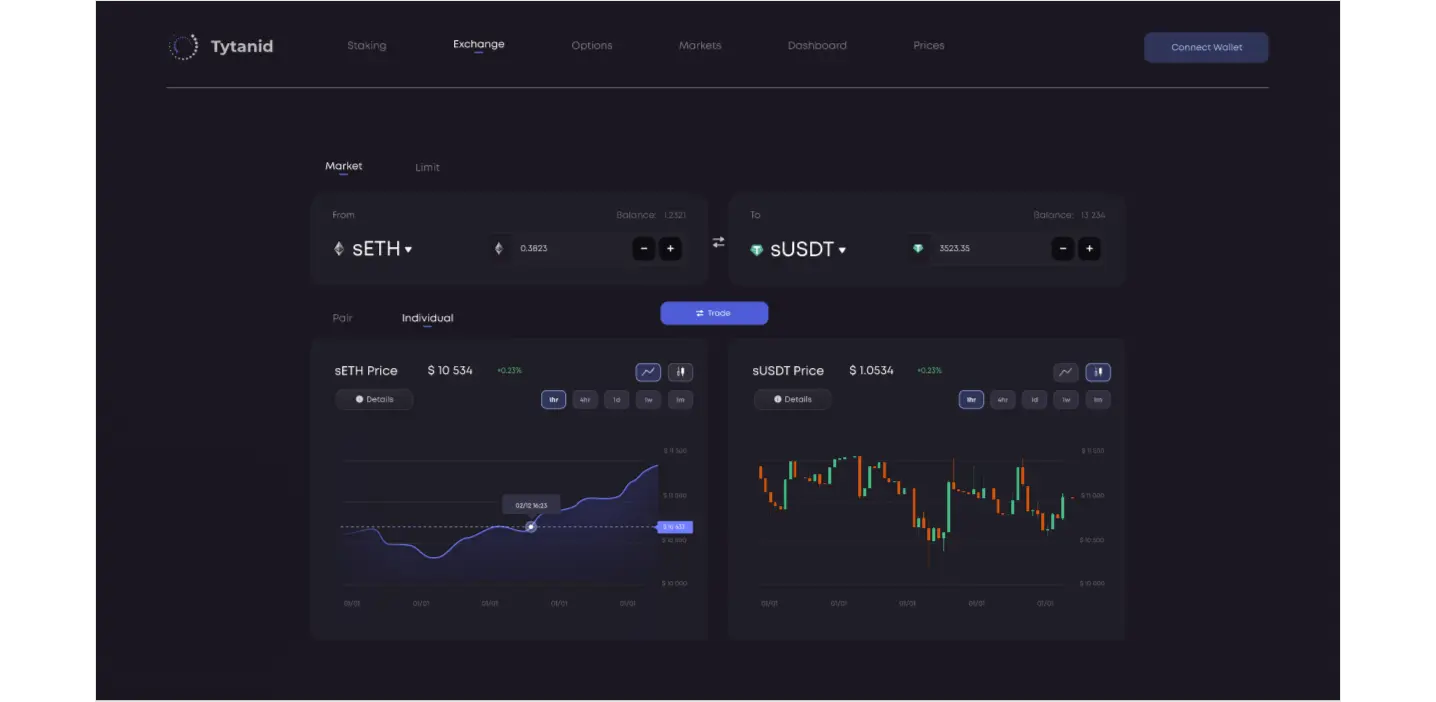

Technical analysis plays a vital role in leverage trading. We can identify trades’ potential entry and exit points using various technical indicators and chart patterns. Indicators such as moving averages, relative strength index (RSI), and Bollinger Bands can provide insights into market trends and potential reversals. Chart patterns like support and resistance levels, trendlines, and candlestick patterns can help confirm trading signals.

By incorporating these strategies into our leverage trading approach, we can enhance our chances of success. However, it’s important to remember that no strategy guarantees profits in the volatile crypto market. Continuous learning, adapting to changing market conditions, and managing our emotions are equally essential for long-term success.

4 Best Practices and Tips for Leverage Trading

As we embark on our leverage trading journey, we must equip ourselves with best practices and tips to navigate the market successfully. By following these proven strategies, we can enhance our trading skills, manage risk effectively, and increase our chances of achieving consistent profitability. Let’s explore some valuable best practices and tips for leverage trading in the crypto market.

1. Start with a Demo or Paper Trading Account

Before diving into live trading, start with a demo or paper trading account. This allows us to practice our trading strategies without risking real capital. It allows us to familiarise ourselves with the trading platform, test different approaches, and gain valuable experience without the pressure of real financial consequences.

2. Begin with Small Leverage and Gradually Increase

It’s wise, to begin with small leverage ratios and gradually increase them as we gain experience and confidence. This approach allows us to understand the impact of leverage on our trades and helps us manage the associated risks effectively. It’s crucial to balance maximizing potential profits and protecting our capital.

3. Keep Track of Market News and Developments

Staying updated with the latest market news and developments is essential for leverage traders. We can make informed trading decisions by monitoring news related to cryptocurrencies, regulations, and market trends. This information can help us identify potential opportunities, gauge market sentiment, and adjust our strategies accordingly.

4. Learn from Experienced Traders and Seek Mentorship

Learning from experienced traders and seeking mentorship can significantly accelerate our learning curve. Engaging with communities, forums, and educational resources dedicated to leveraging trading can provide valuable insights and perspectives. By absorbing knowledge from seasoned traders, we can avoid common pitfalls, gain practical tips, and refine our trading strategies.

Successful leverage trading depends on technical analysis and strategy implementation. It involves managing our emotions. Emotions can cloud our judgment and lead to impulsive decisions. Maintaining discipline, sticking to our trading plan, and managing risk are crucial aspects of trading psychology.

We can position ourselves for success in the world of leverage trading. Continuous learning, adapting to market conditions, and staying disciplined are key ingredients for long-term profitability. Embrace the journey, stay curious, and never stop honing your trading skills.

Conclusion

leverage trading in the crypto market offers exciting possibilities but comes with its fair share of risks. We can confidently navigate this dynamic landscape by understanding the mechanics of leverage, conducting thorough research, implementing effective strategies, and managing risk. Remember, leverage can amplify profits and losses, so it’s crucial to approach it carefully and carefully. By continuously learning, adapting to market conditions, and staying informed, we can position ourselves for success in leverage trading. So, embrace the journey, stay vigilant, and seize the crypto market’s opportunities. Happy trading!

What is leverage trading in the crypto market?

Leverage trading in the crypto market is a practice where traders borrow funds from a platform or exchange to amplify their trading power. It allows them to control larger positions with a smaller amount of capital, potentially increasing their potential profits or losses.

How does leverage affect my trades in crypto?

Leverage magnifies the impact of price movements on your trades. For example, if you have 10:1 leverage, a 1% price increase can result in a 10% gain in your position. However, it also means that if the price moves against you, losses are also magnified. It’s essential to use leverage carefully and understand the risks involved.

What are the margin requirements in leverage trading?

Margin requirements are the percentage of the total position value traders must provide as collateral to open a leveraged position. It acts as a buffer to protect the lender from potential losses. The higher the leverage ratio, the lower the margin requirement, but it’s important to maintain sufficient funds to cover potential losses.

Can leverage trading lead to liquidation?

Yes, leverage trading can lead to liquidation if the position’s value declines significantly. When the position’s value approaches or falls below the liquidation price, the platform may automatically close the position to protect the lender’s capital. Setting appropriate stop-loss levels and monitoring positions closely is crucial to avoid liquidation.

What strategies can I employ in leverage trading to manage risk?

To manage risk in leverage trading, it’s important to employ effective strategies such as setting realistic profit targets and stop-loss levels. Implementing proper risk management techniques, diversifying trades, and staying informed about market trends and news can also help minimize potential losses. Practicing disciplined trading and continuously learning from experienced traders can contribute to successful leverage trading.

As a writer, Ruben is an advocate of blockchain technology and cryptocurrency in general. He writes about all things from cryptography to economics, with a focus on how it applies to cryptocurrencies. He is also passionate about writing about topics such as decentralization, open-sourced software development, and copyright law.